This blog is maintained for the benefit of the entire fraternity of Central Excise Officers all over India.

Friday, May 31, 2013

APPEAL-CAT HYD CASE ON GP 5400 TO ACP INSPECTORS IS COMING UP ON 04.06.2013 IN A.P.HIGH COURT

THE FOLLOWING IS

THE LIST OF OFFICERS IN OA 1051/2010 WHICH HAS BEEN APPEALED IN HIGH COURT OF

HYDERABAD BY THE DEPARTMENT AND IS

COMING UP FOR HEARING ON 04.06.2013 IN W.P.NO.39218 OF 2012. ALL ARE REQUESTED

TO CONTACT P.VIGNESHWAR RAJU ON 9849313988 AND SIGN THE VAKALAT URGENTLY FOR

HANDING OVER TO ADVOCATE BY 02.06.2013.

1. P. Vigneshwar Raju,

2. G Vijaya Raghavan,

3. G. Venkata Raghavan,

4. B. Ramakrishna,

5. M. Narayana Charry,

6. V. Bhaskara Charry,

7. Chitta Sridev Kumar,

8. C.Sridhara Murthy,

9. Donthi

Reddy Chenna Reddy,

10. Rayudu

Rama Mohana Rao,

11. C.S.Srinivas

12. V.Vidya Sagar

13. S.Satyanarayana Sastry

14. Nookala Ramakrishna,

cadre restructuring proposal is cleared by expenditure

As per the information received from SGAIACEGEO, CR has been cleared by the Expenditure and sent to CBEC. Now, it is expected that the COS note would be sent by the CBEC very soon. AIACEGEO is already on the job and pursuing the matter.

Thursday, May 30, 2013

Saturday, May 25, 2013

Thursday, May 16, 2013

Tuesday, May 14, 2013

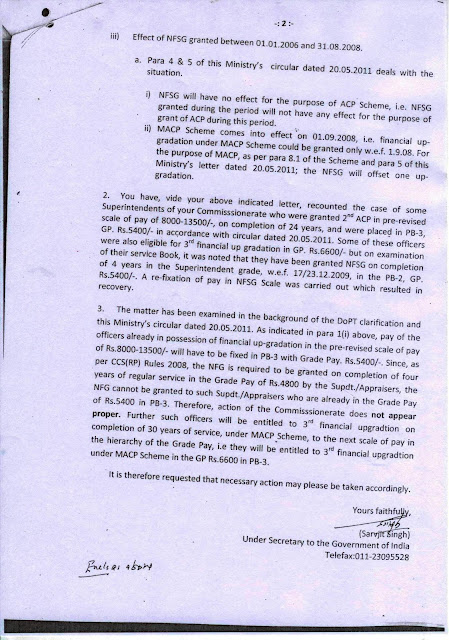

LATEST CLARIFICATION ON ACP Vs TIMESCALE

MESSAGE FROM RAVI MALIK SG OF AIACEGEO------------------

Dear friends,

1. The clarification issued on ACP vs time scale offset is attached herewith.

2. CR is with Expenditure. The issue of its early clearance was raised before the Expenditure Minister on 09.05.13 and he assured of doing the needful.

3. The pay arrears since 1986 at par with the Inspectors of CBI & IB case (CWP No. 13471/08) pending in Jabalpur High Court was discussed with the advocate handing over the available relevant documents to him. He opined that we should also intervene in the matter from the side of Superintendents Asn and asked for some more records which will be provided to him accordingly. After studying all the documents/records, he will prepare the case. It was last updated on the High Court site in 08/12.

Love,

Ravi.

Dear friends,

1. The clarification issued on ACP vs time scale offset is attached herewith.

2. CR is with Expenditure. The issue of its early clearance was raised before the Expenditure Minister on 09.05.13 and he assured of doing the needful.

3. The pay arrears since 1986 at par with the Inspectors of CBI & IB case (CWP No. 13471/08) pending in Jabalpur High Court was discussed with the advocate handing over the available relevant documents to him. He opined that we should also intervene in the matter from the side of Superintendents Asn and asked for some more records which will be provided to him accordingly. After studying all the documents/records, he will prepare the case. It was last updated on the High Court site in 08/12.

Love,

Ravi.

Monday, May 6, 2013

E-filing must for salaried taxpayers also with annual income above Rs.5 lakh

Mumbai, May 7, 2013(TNN): The Central Board of Direct Taxes (CBDT) has widened the scope of e-filing of income tax (I-T ) returns. And one of the changes introduced through a recent notification impacts salaried taxpayers. E-filing of I-T returns is now mandatory for individuals, including salaried taxpayers, earning more than Rs 5 lakh taxable income during the financial year ended March 31, 2013.

Prior to this notification, e-filing was mandatory for

individuals having a taxable income of more than Rs 10 lakh. According to

sources in theministry of

finance, nearly 18 lakh individual

taxpayers fall in the Rs 5-10 lakh tax slab, all of whom will now have to file

their I-T returns online. Salaried employees have to file their I-T returns for

the income earned in FY13 by July 31, 2013.

Salaried taxpayers, however ,

do not have to obtain a digital signature for e-filing their I-T returns. After

having filed online, for verification of the return, a hard copy has to be sent

to the central processing unit in Bangalore.

Salaried

taxpayers having income from salary, house property and income from other

sources such as bank interest can

e-file the simple form – Sahaj (ITR1). However, if they report a loss under the

head income from house property or winnings from lottery or from betting

at a racecourse or even capital gains, then Sahaj form is not applicable and

Form ITR2 or another appropriate form needs to be filled in and filed online. A

free online filing facility is available at https:// incometaxindiaefiling

.gov.in/

“Salaried

individuals earning less than Rs 5 lakh and whose saving bank interest income is less than Rs 10,000 in a year will continue

to be exempt from filing of their tax return, provided they meet the prescribed

conditions. These conditions include that the employer has discharged the

entire tax liability through deduction of tax at source and deposited it with

the government . If an employee has switched jobs during the year, then this

leeway of tax filing exemption is not

available,” explained a tax official.

“E-filing

of I-T returns also helps speed up the process of

granting refunds to taxpayers – the processing is carried out at the central

processing unit in Bangalore . The process of e-filing is now simple. If one

considers only Form 1, as a sample case, as many as 64 lakh I-T returns were

filed during FY 2012-13 . We are equipped to handle the additional e-returns ,”

said a finance ministry official.

According

to L K Jain, a Mumbai-based chartered accountant , “Small taxpayers who are not

computer savvy will now have to seek professional help for filing I-T returns .

The plus side is that the tax authorities have assured speedy refunds when

e-returns are filed.”

Many

chartered accountants said the official website of the

tax department which enables e-filing of returns is difficult to access,

especially during the peak return filing season.

Through

the same notification , the CBDT has also introduced e-filing of tax audit

reports, transfer pricing (TP) reports andMinimum Alternate Tax (MAT)

certificates . Earlier, while e-filing of I-T returns was mandatory for India

Inc, these reports had to be physically filed at the local tax office.

Mukesh

Butani, chairperson , BMR Advisors, said, “It is important to ensure that the information technology system has

stabilized and there are no hiccups as we have seen with digitization efforts

in the past.”

Individuals,

including salaried taxpayers, earning more than 5L now have to mandatorily

e-file their I-T returns Salaried taxpayers with income less than 5 lakh and bank interest less than 10,000 continue to be exempt from filing I-T

returns India Inc can now e-file tax audit report,

transfer pricing (TP) report and Minimum Alternate Tax (MAT) certificate.

Government employees retired before 2006 will get a revised pension:HC

New Delhi, April 6, 2013(Agencies): The Delhi High Court has held that all government employees who retired before 2006 will get a revised pension according to the Sixth Central Pay Commission.

The Delhi High Court passed the judgement which will provide a huge financial windfall to former government employees.

The sixth pay commission, which had raised thesalaries of government employees by a significant amount, was implemented in 2006.

The landmark judgment would almost double the pension amount of the government employees, including both Central government and state government employees.

A bench of Justices Pradeep Nandrajog and V Kameswar Rao gave strict directions to the government to give the arrear to the pensioners within two months.

The court said if the government fails to do so, it will have to pay the pending amount to the retired employees at a whopping interest of 9 per cent.

The bench said: “Mandamus is issued to the respondents to re-fix the pension of the petitioners accordingly within a period of two months. In case, the arrears are not paid within a period of two months, it will also carry interest at 9% with effect from 01.03.2013.”

The court was hearing an appeal filed by the Central government challenging the Central Administrative Tribunal’s (CAT) 2009 order which had said that government employees who retired before 2006 were also entitled to the benefits of the sixth pay commission.

The CAT had passed the order on a petition filed by the Central Government Pensioners Association.

While ruling in favour of the employees, the high court bench pointed out that even the government has admitted that employees who retired prior to 2006 deserved revised pension as per the sixth pay commission.

The bench said: “The government of India has tacitly admitted that it was in the wrong and that the tribunal is correct. We conclude by noting that as regards the substance of the view taken by the Tribunal, even the Central Government accepts its correctness, but insists to make the same applicable prospectively.”

The government proposed that those employees who retired before 2006 be given revised pension from 2012 but not 2006 as pleaded by the Central Government Pensioners Association. The court, however, ruled in favour of the employees.

Courtesy- Daily Mail

UPDATE ON CR BY MR RAVI MALIK SECRETARY GENERAL AIACEGEO

Dear friends, good noon.

2. The correspondence

made during last 2 months

3. All of the units are

again requested to clear their due

Friday, May 3, 2013

Restructuring and Removal of Regional Disparities in Promotions

A meeting of National office bearers of the AICEIA was held

at New Delhi on 29.04.2013. All issues concerning the cadre were discussed in detail, especially the

developments after the Patna Convention.

The stand that was to be taken by the AICEIA in the meetings with the DGHRD and

other Board officials scheduled to be held later the same day and on 30.04.2013

was also deliberated upon and decided.

All AICEIA representatives present in Delhi for the meeting

of office bearers also participated in the meeting with the DGHRD. Additional

DG (HRM) and Additional Director were also present. Points that emerged during

the meeting are narrated below briefly :

1. 1. The Cadre Restructuring file has been sent to Secretary(Expenditure)

by the Revenue Secretary, from whom it should go to the DoP&T.

2. 2. The CBEC proposal is expected to follow the

course taken by the CBDT proposal, which is reported to have been approved by

the Group of Ministers on 29.04.13, and

now awaits clearance from the Union Cabinet.

3. 3. However, even by optimistic estimates, we are

still several months away from seeing even the first promotions arising

out of the CR exercise. The proposed figures include raising the strength of

Gr B Gazetted Executive from the present 13948 to 19108

, and for Gr B non- Gazetted Executives-

from 20,163 to 25,203.

4. 4. On our repeated and insistent demand that

regional disparities in prom otions among Inspectors of Central Excise of

different Cadre Control Zones have to be addressed immediately, the CBEC

has agreed in principle to take decisive action to do away with regional

disparities.

5. 5. On the methods to be adopted to achieve that

end, our Association’s stand is that an exercise of upgradation on the lines of

the one undertaken in 1996 be repeated,

to promote all Inspectors who have completed 8 years of service, or at least

promote all Inspectors to the level of the junior -most Inspector promoted as Superintendent

in any Zone, as on date. The organisational desideratum, however, remains base cadre parity.

6. 6. The DGHRD had a discussion with the Member(P&V) on

the issue on 30.4.13. After this the AICEIA office bearers met the DGHRD again. It is informed that the subject

file will be put up to the Member by

next week. `

7. 7.The Board now appreciates the fact that an All India Seniority List of Inspectors of Central Excise is a fait accompli for the period following the Supreme Court

judgment dated 09.12.1996 in the case of

Radhey Shyam Singh & Others vs. Union of India & Others.

8. 8. Action has now been initiated by DGHRD to draw such

an All India Seniority List of Inspectors. This is already badly delayed since way

back in 1996 itself the Board had taken a decision to introduce All India Seniority for

Inspectors, but never showed enough

resolve to implement it.

9. 9. The AICEIA shall be keenly pursuing these matters

and we should resolve not to rest till we achieve these objectives.

AICEIA CEC – July 27th and 28th, 2013

Chandigarh Circle of the AICEIA has informed that arrangements are underway to host the upcoming meeting of the AICEIA Central Executive Committee at Shimla on 27th and 28th July’13 . All delegates are advised to forthwith make travel arrangements accordingly to avoid inconvenience later and also to curtail expenses. Notice in this regard shall be issued shortly.

Source: AICEIA

Subscribe to:

Comments (Atom)